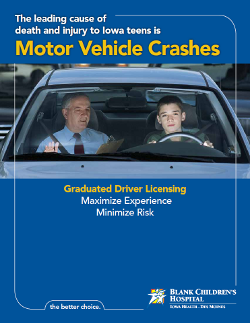

Motor vehicle crashes cause 48% of all teen deaths in Iowa. In the past five years, 162 teen drivers, ages 14-17, lost their lives in crashes in Iowa (CDC, 2009). To address this issue, we need to create an atmosphere where young drivers are supported as they learn and given appropriate guidance in preparation for the complexities of driving.

By maximizing experience and minimizing risks while this experience is gained, we can protect teens while they are learning and produce safer drivers in the long-run.

Because they are still learning, young beginner drivers need to obtain experience gradually, over an extended period of time, in order to develop good judgment and learn the complex skills needed to drive safely.

Research has shown that teen crash involvement can be reduced by improving the structure of driver licensing systems. Graduated Driver Licensing, or GDL, is an experience-based approach that allows young drivers to gain experience while minimizing risks to them and others with whom they share the road.

Please review this Booklet, and feel free to distribute to all of your families with young drivers.

Your Homeowners Policy: Please Read It

We, here at the Insurance Store, Ltd., encourage our customers to read their policy. Yes, it’s very dry reading – somewhat like watching paint dry. Still, we think it’s worth the effort. Then call us if you have any questions or concerns.

Listed below are items of homeowners insurance that can tend to confuse customers:

Flood: No homeowners policies cover damage caused by floodwaters, and some also exclude “surface waters” or water blown by windstorms, (though damage caused by windstorm is covered). Flood insurance is available at low cost by the National Flood Insurance Program (go to http://www.fema.gov for information), but damage is capped at $250,000.

Mold: Coverage for mold damage varies widely. Some companies limit coverage from $5,000 to $10,000 for damage caused by mold. Yet, some companies won’t cover any damage from mold. And some companies limit coverage to a certain type of mold, if found in your house.

Dogs: Some insurers single out aggressive breeds for liability reasons, such as Pit Bulls, Dobermans and mixed wolf breeds. Other insurers state they can refuse to issue coverage if the dog (whatever the breed) has a history of biting.

Replacement Cost: Getting reimbursed for the actual cost of replacing a hail or wind damaged roof or burst pipes, as opposed to their actual depreciated value, does tend to raise premiums substantially. However this coverage comes in really handy where construction costs have risen rapidly or after a disaster when demand skyrockets. Replacement cost terminology may also be in your policy regarding the total value of your home should you have a total loss due to causes such as a fire or tornado.

In any aspect, customers are encouraged to do a little research on their own regarding the wording in their policies. Please don’t be afraid to contact us should you have further questions.